KM Tracker app for iPhone and iPad

Developer: Clement C Wu

First release : 03 Nov 2013

App size: 0 Bytes

A user friendly app for tracking your business trips using the cents per kilometres method.

------------------------------------------------------

How to use:

------------------------------------------------------

1) Tap the Start button to start tracking your trip.

2) Tap the Stop button to stop tracking your trip.

3) Tap the S (Save) button to save your trip permanently.

4) Tap the F (Flip) button to see the newly created trip record. Red trips are unsaved trips, black trips are saved trips.

5) Tap the C (Clear) button to clear the map for new trips.

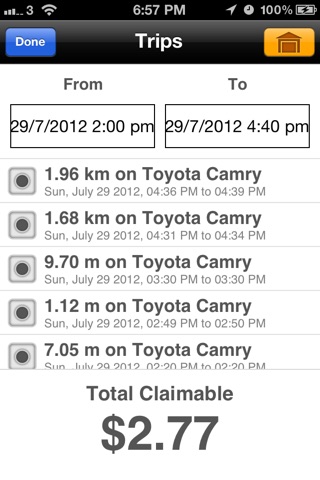

At the bottom of the trip manager is the calculated total claimable tax refund for all your vehicles and trips combined, taking into consideration engine capacity, vehicle type and trip distance in kilometres.

Trips which have no vehicle set for them or which are unsaved will not be included in the tax refund calculations.

If you wish to see how the calculation was derived, click on the See ATO Website Information link when adding a new vehicle in the vehicle manager.

Note: the ATO states that each vehicle can claim up to a maximum limit of 5000 business kilometres. Anything more will be disregarded. The app also takes this factor into consideration when displaying the total claimable refund.

------------------------------------------------------

Tips & Tricks:

------------------------------------------------------

- Wait for a good lock-on to your GPS position before starting a trip. This will ensure your trip recording is as accurate as possible at the start.

- Pull down on the table to reveal the date filters. The tax refund shown is based on what is visible in the list of trips. Using date filters, you can for example tell the app to show the tax refund for the first 6 months of a financial year rather than the full year.

- Swipe on a row to delete trips which you feel are invalid in the trip list or swipe on a row in the vehicle manager to delete a vehicle. All trips which are linked to the vehicle to be deleted will be unset.

- Tap check boxes next to a trip to include or exclude a trip from displayed tax refund, the results are updated immediately.

- You can tap on a check box next to an unsaved trip (red colour) to save a trip, given that you already have set a vehicle for that trip. The app will ask if you wish to save the trip permanently.

- Press and hold on a row in the trip manager to change the vehicle for a trip.

- If you made a large number of business trips which you forgot to set vehicles for, simply go into the vehicle manager (the garage icon in the top right), add a new vehicle. The app will ask if you wish to update all those trips with the newly added vehicle.

- In your garage, tap on the check box next to each vehicle to include or exclude the vehicle and all trips linked to that vehicle, from the tax refund calculation.

------------------------------------------------------

Features:

------------------------------------------------------

- Intuitive start-stop tracking with live route rendering on map.

- Intelligent trip manager to calculate total claimable tax refund for business trip with live updates as you add, remove vehicles from your garage and include or exclude specific trips from list of trips.

- User friendly vehicle manager to manage your business vehicles.

- Smart date filters to show only trips from a starting date, all trips until a stopping date or trips between two dates down to the minutes.

- Trip records with full details of trips including a display of the actual route taken.

------------------------------------------------------

Disclaimer

------------------------------------------------------

Continued use of GPS running in the background can dramatically decrease battery life.

Due to GPS hardware accuracy limitation, some trips may not be accurate. It is recommend that each trip is checked for validity before using it in your tax return.